Your order is being processed.

Please do not leave this page

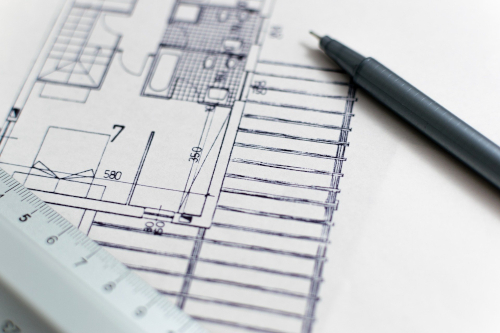

When financing a property, there are two main aspects that play the most important role: the applicant's personal creditworthiness and the property itself, which ultimately serves as a security. Therefore, loan recipients must submit documentation not only about their financial situation, but also about the real estate. An absolute must is a dimensioned floor plan for the bank, which contains all the necessary information for the valuation. Such plans are also important for potential buyers. It is only on the basis of these plans that it is possible to determine whether the information provided by the seller or the real estate agent in terms of living space and usable space is correct.

Banks have been dealing with increasing regulation for years. In 2016, the Residential Mortgage Directive further tightened audit obligations and harmonized them at the EU level. This includes the sound valuation of the mortgaged property. Depending on the type of refinancing, specific requirements apply to the accepted valuation methods.

Therefore, almost all banks now require a wealth of documents to reliably convey the current value of the property. For the bank, a dimensioned floor plan is one of the documents that cannot be dispensed with for the reasons mentioned above. Prospective real estate buyers who want to have their financing options checked should therefore have all technical documents, including a dimensioned floor plan, ready for the bank at the consultation meeting.

It is not without reason that a dimensioned floor plan must be submitted to the bank as well as during sales negotiations and purchase negotiations. It contains exact data on the layout of the rooms, the arrangement within the building and, above all, the living area and usable floor space. At a single glance, the viewer can see whether the layout is functional or whether there are enclosed rooms. If rooms can only be accessed through another room, this will affect the value of the property. This information is not only relevant to the lending institution, but is of interest to any potential buyer.

An important criteria is that a floor plan shows all relevant dimensions in chains so that they are relatively easy to understand. Dimension chains are created at the edge of the sheet and make it possible, for example, to determine the size of the room or certain partial areas.

A dimensioned floor plan, like the one for the bank, shows the cross-section of the object from above. The building section drawing, on the other hand, runs vertically through the building. This allows you to read the height of the ceilings, the thickness of the walls, and the slope of the roof. This is relevant, for example, for rooms in the attic, since only areas above a certain ceiling height can be counted as living space.

In case of new buildings, the required technical documents are easily provided by the home constructor or the architect. In case of older existing properties, problems may arise, depending on the year of construction.

Important: Only a dimensioned floor plan is accepted by the bank today. In many cases, this must be stamped and signed by the builder or an architect. Self-created sketches are hardly ever accepted as documentation.

All technical documentation of the property is part of the building file and can be requested from the building office (which can take up to 4 weeks). For older buildings (built before 1945), there may be no records because the documents were lost during the war. In other cases, the old drawings are very confusing and the numbers needed can hardly be obtained from the records. If existing documents are not usable, a service provider (such as an architect) must be hired to create the drawings. However, there are also service providers who rework existing floor plans at much lower cost. They create new drawings from the existing documents and a dimensioned floor plan is created for the bank, which usually meets all requirements.

Complete technical documents should be considered not only for financing consultations, but also for sales negotiations, planning with building contractors or for the preparation of a meaningful exposé. In this context, revision by specialists is extremely valuable. This can be, for example, a color design or drawn-in furnishings. In this way, a dimensioned floor plan suddenly becomes an appealing sales document for the bank.